Who Owns Your Contracts?

January 24, 2024

contracts Consulting legal operations contracts lifecycle management

For most businesses, managing transactions in a consistent (or at least semi-consistent) manner across the company is a substantial challenge. Each part of the business seems to have its own approach to its relationship with the law department and its own definition of which entity is responsible for what in the third-party relationship process. These inconsistencies can be a tremendous drag on the company, particularly the law department, which must create and manage a different process for each internal client. This mishmash of approaches also creates contracts-related risks, such as those from company-wide events or emergent uncertainties that require rapid analysis and response.

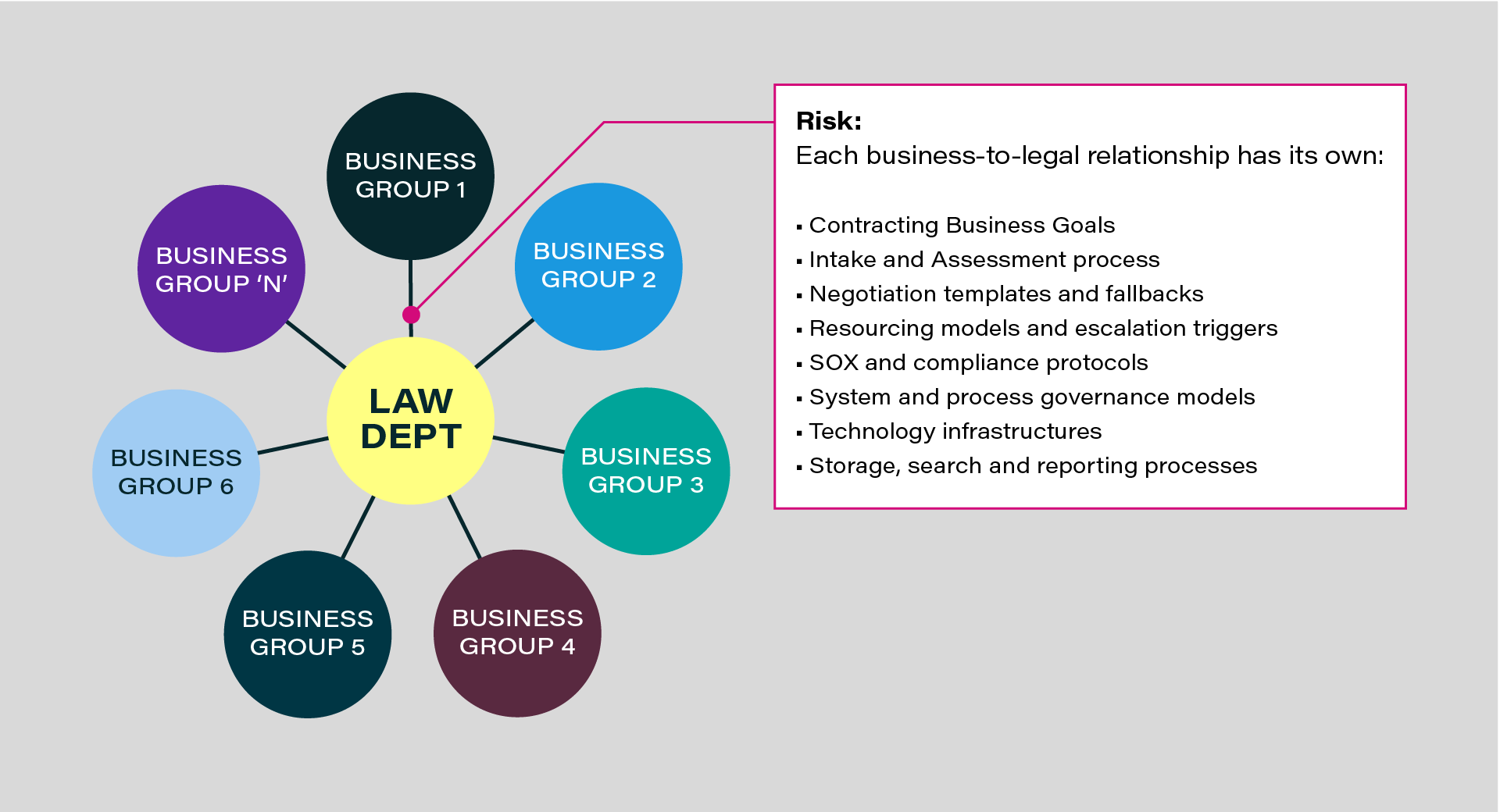

Consider this diagram of the current approach to company-wide transactions at many – perhaps most — companies:

This sort of approach is not by design. It develops organically according to various factors. In our experience working with law departments, my Elevate colleagues and I frequently see several reasons for the existence of these sorts of disjointed approaches:

- Each legacy organisation within the business has its own processes and evolves them at its own pace

- In acquisitions, the acquired entity gets ‘tacked on’ to an existing approach instead of fully integrated into it

- The law department’s organisation is fragmented, with different portions of it tied to individual business or revenue lines rather than centralised by area of law

- The assumption that different businesses have unique requirements governs the approach to the issues of regionalisation versus centralisation

Many companies accept this status quo as immutable (‘just the way things are’) or rationalise it (‘we’ve always done things this way’). But things don’t have to remain jumbled, nor should they.

Transactions are the lifeblood of a business. They dictate revenue, legal obligations, compliance requirements, supply chain, and nearly everything else. They interconnect every part of a business. Just as human health depends on the condition of an individual’s heart (to and from which all blood flows), a business’s health. – i.e., its success at operating profitably, legally, safely, and efficiently – depends on a centralised, comprehensive, and consistent operations structure for how the business does business – that is, transactions – with customers and suppliers.

But where within a company should this entity sit? Mary O’Carroll, Chief Community Officer at Ironclad and a legal operations industry pioneer, addressed this exact question in a recent article, ‘Why GCs Should Take Over Contracting’.

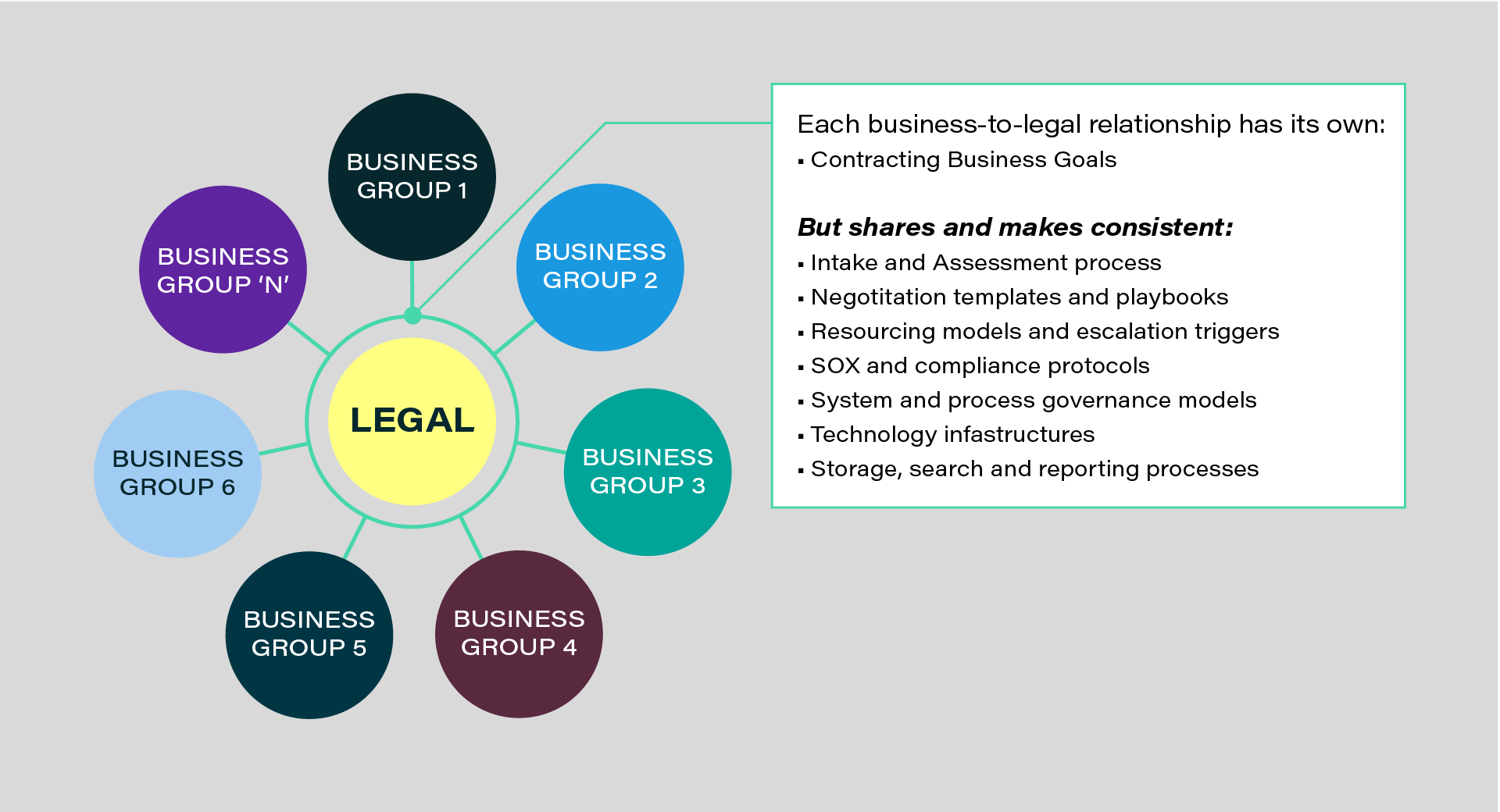

My Elevate colleagues and I agree with Mary about many things, including her view that the status quo is inadequate. However, our teams take her concept one step further in that we propose companies install a Central Transactions Office, headed by a Chief Transactions Officer, to operate as a centralised team charged with helping across the entire business rather than some sub-part of it. Organisationally and operationally, the CTO doesn’t sit solely with the law department or elsewhere within the business but bridges both. In contrast to the diagram above, the CTO looks and operates more like this:

In our model, the responsibilities of the CTO (both the leader and the office) include developing, governing, and rolling out:

- a central manner and workflow in which the business requests contracts and the legal or contract management teams (or both) assess and respond to them

- standard forms and templates for defining company contract templates and negotiation playbooks

- a consistent framework for contracts resourcing, including an ARCI for who does what and when

- a lean and common set of technologies that meets the spectrum of contracting needs across all groups

- a central repository and process for storing all agreements across the company in an easily searchable and reportable manner, and that includes controls for compliance

- A mechanism that collects and centralises contracts-related information ed and makes that information readily available to all for reporting/analytics

We know our audiences like to get specific (especially when we recommend a different approach), so let’s go there. Here is a detailed framework for establishing and enforcing the Central Transactions Office (CTO) governance model across a company:

| Decision Area | Business Function | CTO | Legal | IT |

|---|---|---|---|---|

| Defining End-to-End Business Contracting Process | A, R | R | R, C | I |

| Establishing / Governing Templates | C | R | A, C | I |

| Training Business On Templates and Process | A, R | R | C | I |

| Establishing Legal and Commercial Negotiation Playbooks | A, R | R | R, C | I |

| Setting Approval Authorities | C | R | A, R | I |

| Drafting first version of agreement | A, R | R* | C | I |

| Negotiating Agreement | A, R | R* | R, C | I |

| Executing Agreement | R | R* | R | I |

| Storing Agreement | I | A, R | I | I |

| Extracting / Managing Obligations | A, R | R* | I | I |

| Maintain and Document Contract Process and knowledge base | C | R | C | I |

| Automating Processes | R | A, R | C | R, C |

| Reporting / Analytics | R,I | A, R | R, I | C |

* CTO can enable itself to be centrally ‘R-responsible’ for these items by implementing cost-effective shared service teams and outsourcing

Note that all parts of the business (including legal) should support and fund the office without any of them being responsible or accountable for the office. Instead, like any other corporate function and office (finance, marketing, HR, etc.), the CTO would have an independent leader who reports to the company’s top leadership and runs the office to serve the entire company by supporting transactions processes and reporting. In our model, the CTO (both the officer and the office) operates in a neutral, ‘non-partisan’ manner that benefits all users alike and serves as a trusted partner and resource for business client leaders in transactions operations, enabling those leaders to sharpen their focus on executing their roles and leveraging their expertise.

Back to Expertise