Looking Back, Looking Forward: 2024 Edition

January 26, 2024

legal tech trends legal industry law department big 4 law firm

As I usually do each January, I assess the year just passed and offer my thoughts on what’s ahead. You can see how accurate my crystal ball was in 2023 and 2022.

Elevate’s 2023 Performance and Achievements

While we encourage our kids to work hard at school, if we are honest with ourselves, few of us enjoy hard work, and even fewer of us volunteer to make hard choices – unless we have to. Yet many of us derive a real sense of accomplishment from the results we achieve from making hard choices, working hard, and doing the hard work. What gets me and my colleagues out of bed in the morning is solving problems for our customers. For the eighth consecutive year, Chambers ranked Elevate as a Band One (highest-ranking) law company in every category for which we were eligible. Our quarterly customer Net Promoter Score average for the past year rose to 71, the highest ever and way above the average for legal service providers. Thank you to the customers who put your reputations in our hands.

I am delighted to report that in 2023, we suffered no customer churn and gained 149 new customers, including 11 Global 2000 law departments and four Global 200 law firms. Having experimented with building captive/in-house capabilities or other providers, some of these new customers committed to multi-year contracts with us as their partner for more complex work this year. More customers than ever now use both our software and our services for their routine legal work. In 2023, some customers reduced their spending on third-party SaaS software for their internal legal ops and started using the software we extend to them with our services. In August, we moved our URL to www.elevate.law to concisely express our ambition to integrate software and services to improve routine legal work.

None of this would have been possible without the hard work of all the people at Elevate. Our experts were often go-to sources for industry publications and contributed to flagship publications such as the Association of Corporate Counsel’s ACC Docket and the World Commerce and Contracting’s Contracting Excellence Journal. After much work from every part of the company, we released Our Principles in January, which helped us retain our talent – we saw less than 15% global attrition. Thank you, fellow Elevaters!

Financially, Elevate grew completely organically to record revenue of $100 million and record EBITDA of $10 million in 2023, which supported our closing $40 million of growth financing from Runway Growth Capital in June.

The Mood of the Legal Industry

Optimism faded in the legal industry last year as anxiety among law leaders rose in the face of law department staff reductions, law firm consolidation, and, unfortunately, even some failures. Even as interest in AI for law reached a fever pitch, concerns have intensified over its impact on law (more on that below).

Law Departments: Challenges and Opportunities

Law departments face 2024 with no letup in the pressure to demonstrate business value amidst reductions in staff sizes, stagnant budgets, and more burdensome compliance obligations. The need to ‘do more with less’ has never been greater. Process change and technology investments such as outside counsel spend management and contracts lifecycle management must have an impact quickly. Recent high-profile industry failures have tarnished reputations. Picking an experienced integration partner who will help you avoid the potholes and stick with you through the challenges without surprising you with unbudgeted bills has never been more important. Fixed costs can be avoided by outsourcing routine business processes such as contracting, compliance, or legal ops. Outsourcing can also help law departments avoid staffing for sudden peaks of work that demand expertise quickly, such as electronic discovery, data breach response, or due diligence.

Law Firms: Challenges and Opportunities

The law firm compensation arms race is not over, and overhead remains at historic highs, putting downward pressure on profits. Another round of rate hikes will only antagonise clients who scrutinise their legal spend more closely than ever. Among the largest law firms, there is growing stratification in profits and compensation. Further consolidation is likely, which only encourages partners to focus more on their personal book of business than on the firm as a platform. Against this backdrop, managing partners recognise they must deliver growing profits year over year – or risk losing talent. Firm leaders know that near-term business success and long-term survival require attracting, developing, and keeping their best legal talent integrated with innovative, efficient client-facing legal operations. While a few firms are spending on captive ALSPs, many others are quietly building competitive advantage by effectively partnering with law companies for efficiency, thereby focusing their precious management time and money on the expertise of their lawyers.

A Word About AI and Law

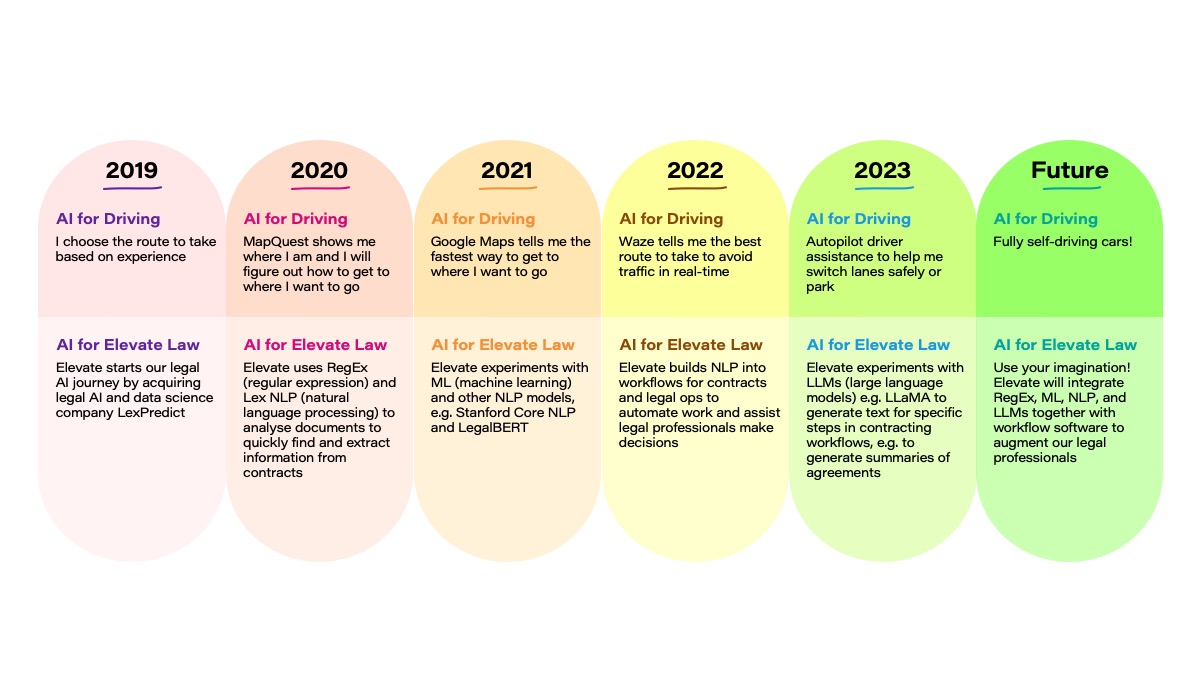

AI for law drew enormous attention in 2023 and deserves detailed discussion. In the near term, we will see an explosion of software tools for specific use cases. The tools will have ‘AI-inside’ their workflows. Legal professionals will begin to trust the ‘legal satnav’ software to tell them which route to take to avoid traffic. They will care less about how new LLMs draw business insights from unstructured data that previous NLP or ML models struggled with. See the chart below for Elevate’s journey to build AI into our software and services.

Humans will need to remain in the loop while we figure out the hallucinations and biases of the LLMs. The battle over AI copyright infringement between the tech sector and content owners will be resolved, providing important clarity about which LLMs to deploy and how. CIOs will define, map, and take action to reduce the infosec attack surface of their software and data. CFOs and GCs will start to understand AI’s true costs and environmental impact. Investors will want to see a return on their massive investments. All of this points to consolidation in the medium term – certainly place your bets, but be careful to avoid becoming locked into one AI provider.

Law Companies: Challenges and Opportunities

For law companies, several developments stood out in 2023. Competition from the Big 4 diminished as they pulled back or withdrew entirely from the business of law and legal ops market to focus on legal advisory work, more directly competing with law firms. Some law firms invested in their captive ALSPs, while others collaborated with law companies, and others pursued a hybrid of both. Some law firms decided to sell themselves to PE or to sell their captives or tech units to PE to fund the capital investments required to remain competitive. Growth in the CLM market slowed sharply. As I predicted a year ago, funding for legal tech (aside from AI) has dwindled, unfortunately leading more legal tech companies to shut down despite the best efforts of their founders, employees, and investors.

Looking to 2024 and beyond, law remains an attractive massive market with the opportunity to modernise, but change requires time and patience. A better mousetrap is necessary but not sufficient. Hard work and hard choices are necessary for a sustainable business in law.

Back to Expertise